Partners

CPR tax directors’ roundtable: tax insights in focus

Event ended.

Join EY for an in-depth discussion and networking with fellow tax and finance leaders in the consumer product and retail (CPR) industry.

EY, as a tax leader in the CPR sector, staying abreast of the rapid changes and updates in the sector is crucial in formulating your tax strategies for your organisation. With the recent Base Erosion and Profit Shifting (BEPS) 2.0 Pillar Two released by the Organisation for Economic Co-operation and Development (OECD) Secretariat in June 2024 and the Seventh Edition of the Singapore Transfer Pricing Guidelines, these new changes will impact how your organisation manages taxes across borders.

You are cordially invited to an exclusive roundtable, specifically tailored for a select group of tax and finance directors and leaders in the CPR sector in Singapore. This roundtable provides a platform to engage with and gain insights from industry peers and EY tax professionals on the latest tax developments relevant to the CPR sector.

Join EY for this unique opportunity for an in-depth discussion, knowledge sharing and networking with your fellow tax and finance leaders in the industry. Participants are encouraged to send in their questions in advance upon registration in the RSVP form.

Roundtable highlights

- Recent BEPS 2.0 Pillar Two developments, including highlights of Singapore's Multinational Enterprise (Minimum Tax) Bill and an overview of the Administrative Guidance released by the OECD Secretariat in June 2024

- Corporate tax challenges and concerns relevant to the CPR sector

- Transfer pricing key issues and controversy management

- Goods and services tax issues and insights

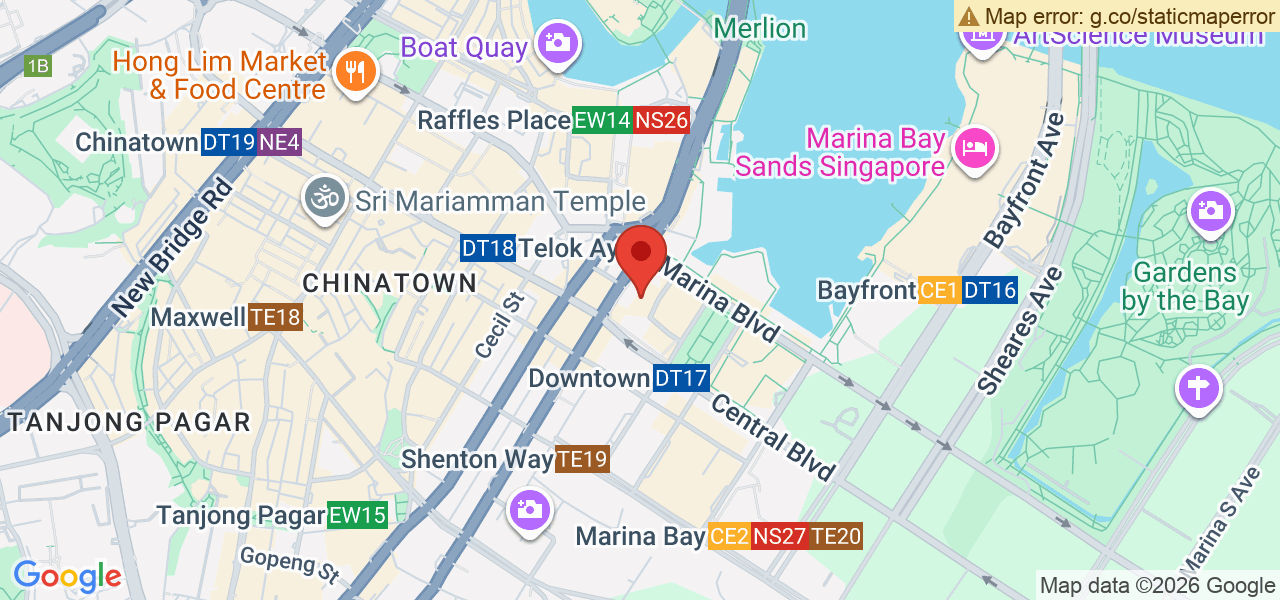

Event Location

CPR tax directors’ roundtable: tax insights in focus

Event ended.