Analyses & Studies • Publications

How Sustainable Bond Innovation fuels Positive Change

The expansion of the sustainable bond market is opening up new funding opportunities for a wider range of companies and connecting investors with projects that support Asia’s transition to a low-carbon future.

By Raj Malhotra, Head of Debt Capital Markets Asia Pacific, Societe Generale

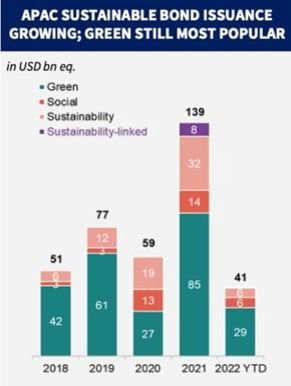

Sustainable bonds are beginning to make their mark in Asia Pacific. Issuance in 2021 reached an all-time high of US$139 billion as companies and governments raised funds for green, social, and sustainable initiatives. In this surge of activity, the arrival of sustainability-linked bonds (SLBs) holds particular promise for the region, where innovative financing solutions will be essential to the transition to a lower-carbon and more sustainable society.

Until recently, the proceeds of sustainable bond issuance could only be used to directly finance or refinance eligible green and/or social projects. While the lion’s share of these was initially made up of green bonds earmarked for environmental purposes, COVID-19 prompted a surge in demand for social bonds as the world’s focus shifted to mitigating the economic and social impact of the pandemic on vulnerable communities. This engendered a new sense of purpose in the social bond segment that is likely to endure even as the recovery gathers pace.1 And in line with the greater demand for social bonds, there was a significant uptick in issuance of sustainability bonds, the proceeds of which can be used to fund a combination of green and social projects.

Figure 1: Asia Pacific sustainable bond issuance

Source: Bloomberg

Forging new frontiers through Sustainability-Linked Bonds (SLB)

SLBs made their first appearance in Europe in 2019. The concept marked a big departure from the focus on the use of proceeds for green, social, and sustainability bonds, instead allowing issuers to raise funds for general corporate purposes. The crucial caveat, however, is that SLB issuers must commit to achieving ambitious, material, and measurable environmental or social targets by set deadlines, such as increasing the share of renewables in their overall energy mix or improving gender diversity in the boardroom. Failure to meet those commitments generally results in issuers facing an increase in the coupon rate or payment of a premium at maturity, giving issuers an incentive to meet their sustainability commitments.

An increasing number of corporates have been turning to SLBs to tie their corporate financing to their sustainability ambitions. The format is especially popular in the utilities, consumer, materials, and healthcare sectors, for both investment grade and sub-investment grade issuers. While still limited, financial institutions and sovereigns have also started to tap the SLB market. Societe Generale has been involved with recent landmark transactions, including Australian conglomerate Wesfarmers’ debut Euro-denominated SLB, the first SLB from a sovereign for the Republic of Chile and one of the few SLBs from a financial institution for alternative asset manager Intermediate Capital Group.

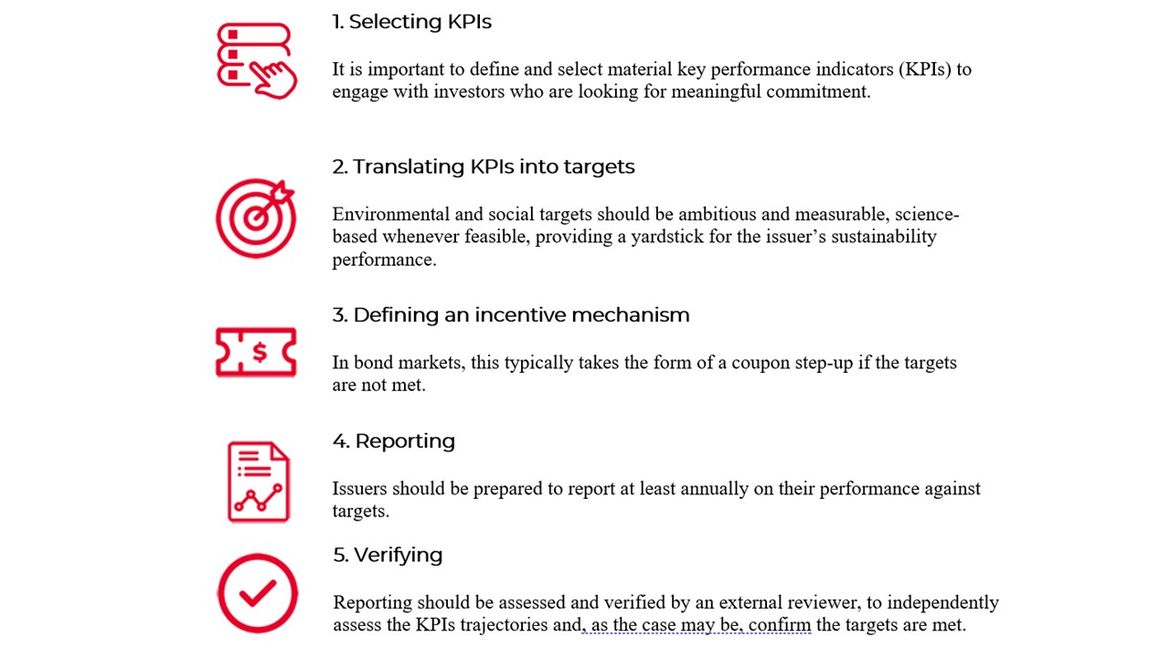

For companies considering an SLB, there are five key steps to consider:

Further expansion and innovation ahead

Beyond SLBs, we are optimistic about the prospects for all ESG investment products, with the near exponential growth seen over the past few years driven by a corresponding increase in investors’ focus on sustainability considerations in their investment processes.

As the sustainable bond universe continues to expand, there will be further innovations that combine capital and sustainability, and we look forward to continuing our contribution to the growth of this market in Asia Pacific. As well as taking SLBs to new markets, we recently acted as joint bookrunner on Singapore’s inaugural sustainability bond for UOB, the first sustainability AT1 from an Indian bank for Axis Bank, one of the first Tier 2 green bonds in Australia and New Zealand for Westpac, and numerous green, social and sustainable bonds for Chinese and South Korean institutions. In addition, we helped structure and execute the first green bond from a metals and mining company in Asia Pacific for Australia’s Fortescue Metal Group, which was also the first company from its sector globally to establish a sustainability financing framework.

We believe this kind of innovation in new structures, sectors, and countries is essential to supporting the climate transition and the sustainability agenda in Asia Pacific. There is no doubt that issuers and investors are embracing the concept of sustainable bonds, and we are excited to help channel this enthusiasm towards financing that makes a positive impact.