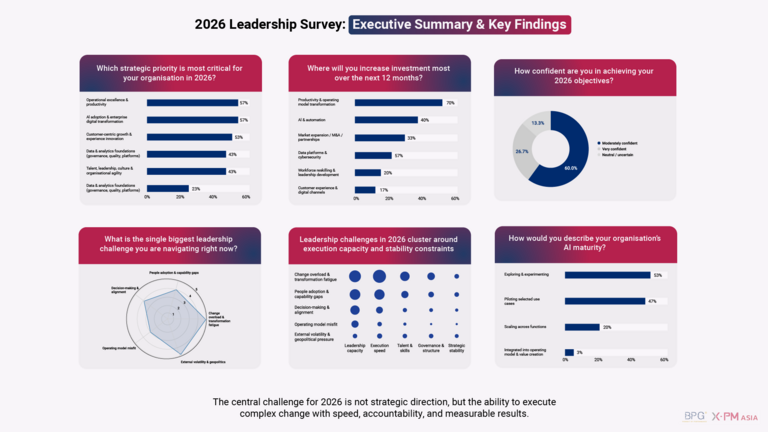

Analyses & Studies • Publications

Geodis | Supply Chain Compliance: a key success factor for cross-border business

Discover why you should implement an effective Internal Compliance Program (ICP) and how.

Under the best of circumstances, the supply chain is a Gordian knot that can quickly unravel to severely impact anything from job creation to market competitiveness and economic growth. Now, throw in COVID-19 containment measures by governments globally, continually changing national export and import regulatory controls, dramatic developments in global affairs, and the fact that global trade never truly recovered from the 2008-2009 financial crisis, and we have ourselves a risk calculus in logistics that's more complicated than ever.

So how do you ensure supply chain compliance?

Ensuring supply chain compliance with an Internal Compliance Program (ICP)

As a major international logistics company, we see a diverse range of high-volume goods crossing international borders hundreds of times each day, and we have witnessed the interplay of global events impacting businesses increasingly. As rules and regulatory requirements continue to change rapidly, cross-border activities are at a high risk of running into regulatory non-compliance roadblocks if the companies managing the logistics and the paperwork do not have well-oiled customs and trade compliance procedures in place.

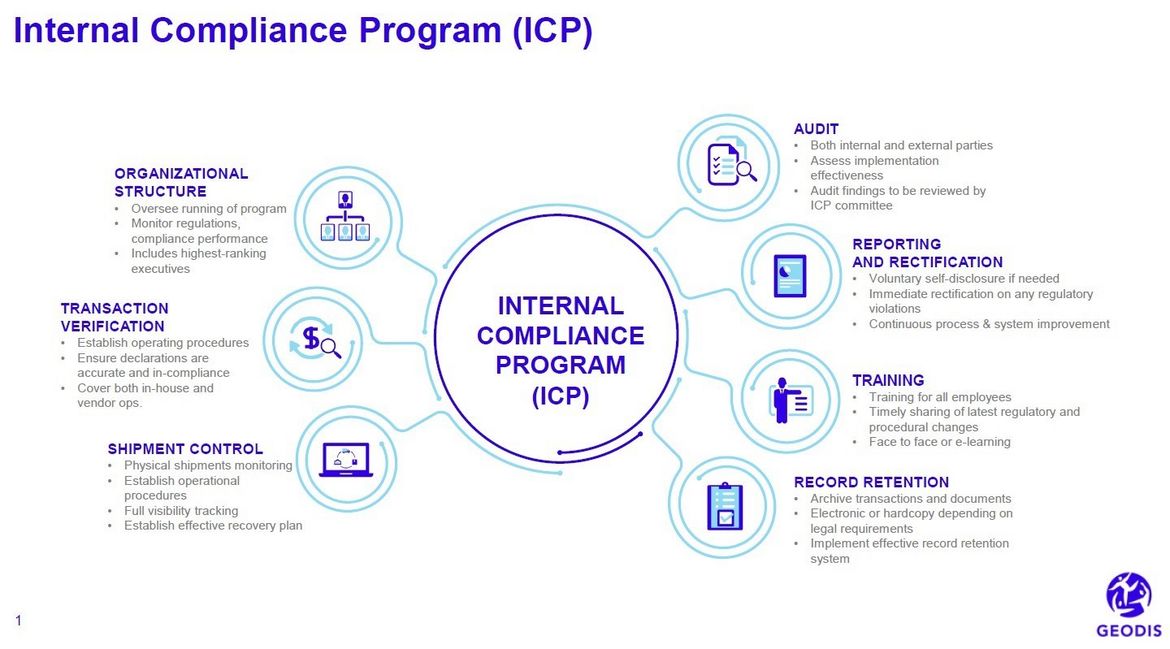

The most important tool for companies to avoid tarnishing their reputations is an effective Internal Compliance Program (ICP). ICP exists to ensure complete compliance with customs and trade regulations at all times.

Originally designed to ensure complete adherence to each country's export control legislation, ICP was essentially an in-house manual comprised of internal protocols and structured procedures for dealing with all manners of risks in export control. But the growing complexities of today's world order call for the expanded coverage of ICP on customs and trade compliance.

The seven key components for an efficient ICP

(1) An adapted organizational Structure

A committee of customs and trade compliance management will oversee the effective running of ICP in the company. Appoint a dedicated ICP lead who has complete oversight of customs and trade regulations and compliance performance. It is also essential that the highest-ranking executive in the firm to be part of this committee together with other senior executives from the legal and operations departments.

(2) A reliable transaction verification process

This is the most important component of any ICP - establishing a comprehensive set of operating procedures to ensure all customs and trade declarations are accurate and in accordance with local and international rules and regulations. Procedures should cover valuation, classification and import/export permit requirements of all customs and trade transactions for both internal operations as well as sub-contractors, logistics partners and distributors.

(3) Shipment monitoring procedures

Strong control in customs and trade declarations that meet all relevant regulations, and safeguards to ensure physical shipments are handled in accordance with all customs and related regulatory requirements are equally important as part of your ICP. Having a set of operational procedures can help your internal team and logistics suppliers to proactively monitor, with full visibility, the flow of shipments around the world. It is also essential that you have an effective recovery plan in case of any deviations during transportation.

(4) Regular supply chain compliance audits

Beyond the implementation of these operating procedures, companies need to carry out internal audits on internal entities as well as external partners by an independent external party at least once a year. These audits ensure customs and trade compliance management is being properly implemented in accordance with the ICP. Regular audits are also useful in ensuring the ICP is up-to-date with regards to the latest changes in regulations around the world.

(5) Reporting and Corrective Action Plans (CAPs)

Ensure your ICP committee reviews these audit reports to spot any issues and gaps that have been identified during the audit. This also means opening channels for auditors to report any issues to ICP committee members immediately. A voluntary self-disclosure may be required depending on the nature of the issues. In addition, any regulatory violation that calls for immediate rectification also means Corrective Action Plans (CAPs) will be required from the relevant department where the non-compliance is found.

(6) Company-wide compliance training

Up-to-date training for all employees is essential not only for new hires but existing employees to ensure the entire organization fully understands the latest control procedures and regulatory changes, as well as any implications for non-compliance.

(7) An efficient record retention system

Lastly, all customs and trade transactions and supporting documents must be archived and stored for a fixed period of time as stipulated under local laws. Companies must check if these records can be stored electronically or in hard copy in accordance to related statutory requirements in each country. Additionally, companies should ensure that they implement a record retention system with data retrieval and backup capability.

Extending ICP to subsidiaries and suppliers

To say that the pandemic has had a profound impact on global trade and logistics is an understatement. Companies need to invest time and effort to work closely with their business partners to ensure end-to-end regulatory compliance in customs and trade control in an increasingly complex world. This means that all requirements under the ICP are equally applicable to any subsidiaries and suppliers.

This is a common problem for many multinational corporations when they empower local subsidiaries in developing countries to appoint local customs brokers that usually lacking in strong process and system control; they may not be fully aware of the importance of customs and trade compliance. Sooner or later, any leakage in global supply chain compliance due to an overseas subsidiary or supplier can cause detrimental impact to the company.

It behooves all players in the entire supply chain ecosystem to be fully aware of the importance of customs and trade compliance. Ultimately, any weak link in the global supply chain can have severe repercussions for companies, including damage to their brand reputation, severe fines, or even more dire consequences that affect their ability to operate effectively in markets.

Source: GEODIS